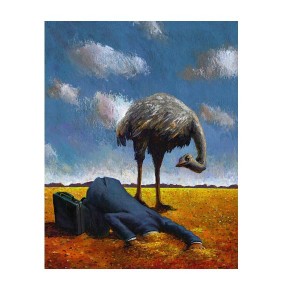

As a business plan coach and a small business lender, I think I’ve heard all of the objections to business planning—it takes too long, it’s wasting valuable marketing time, it’s difficult, it’s complicated, the opportunity will pass me by if I take time to plan, I know a successful business owner who never wrote a plan, nobody reads business plans anyway, the minute you write a business plan it changes—the list goes on. All of these rationales arise from a lack of understanding about what a business plan is and how it can stack the cards in the entrepreneur’s favour.

As a business plan coach and a small business lender, I think I’ve heard all of the objections to business planning—it takes too long, it’s wasting valuable marketing time, it’s difficult, it’s complicated, the opportunity will pass me by if I take time to plan, I know a successful business owner who never wrote a plan, nobody reads business plans anyway, the minute you write a business plan it changes—the list goes on. All of these rationales arise from a lack of understanding about what a business plan is and how it can stack the cards in the entrepreneur’s favour.

When tackled in a practical way, the business planning process builds confidence, saves houses, and changes lives. The true value is found in the process of business planning; it enables a person to step back and take a sober look at what they’re about to invest, the risks, the rewards, and how to get where they want to be. If you’ve ever lost a major investment, like a vehicle or a house, you’ll understand how challenging it is to acquire money, and how senseless it is to throw it away.

The reason so many people leap into business without business plans it that it’s confusing. From my observation of thousands of entrepreneurs starting out in the under $100,000 business arena, here are what I see as the main areas of confusion about business planning.

- What is the purpose of a business plan? Those objecting to doing a formal business plan miss the main point of it, which is to educate the one doing the business plan. Anyone that thinks they can bypass a week or two of business planning will invariably end up investing that time and much more in some other way—for some the lessons will be jammed into their cluttered day-to-day business life, others will pay for their learning through the school of hard knocks, and far too many end up broke or bankrupt. Of course there are a number of other great reasons to develop a business plan; and don’t miss the critical importance of proving your business case.

- What is a business plan? There’s confusion out there about what constitutes a business plan. There are a myriad of viewpoints thrown into the market – from the elevator pitch to the one-page business plan, all the way up to the 200-page missive that even the most chronically detailed of bankers and economists resist reading. Of course the average person seeking to start a business will lean toward the easier sounding business planning options—what they don’t realize is that you have to go through the very same process to research and write a 1, 2, 8, 20, or 200-page business plan, if that plan is to do its real job, which is to educate the business owner. To state this differently, once you go through the process of researching and writing a business plan, you will be positioned perfectly to shape it into the various formats needed to navigate the business world—the elevator pitch, the one-page business plan, the 20-page business plan, a simple loan application, and detailed operational versions of action planning such as start-up, marketing, operational, and financial action plans.

- What is market research and how does it differ from feasibility? There’s confusion about market research and feasibility. The first bit of grey is in the question of whether market research is considered to be a part of business planning or separate from it. I consider market research to be the early part of the business planning process. It includes the researching of your business opportunity, the market, and the industry you’ll be competing in once you get into business. Market research includes the determination of whether or not your business idea will be feasible. It involves pulling together the lion’s share of the business, market and industry information; it is an objective look at everything that might stop the business from succeeding. It also entails taking a close look at the person or people who are initiating the business and whether or not the people fit the venture and vice versa.

- Who is the business plan for? The business plan is, first and foremost, for the entrepreneur who’s starting or growing an enterprise. Yes, the plan is key to approaching lenders, investors, or potential partners—and there are a smattering of other ways to use a business plan—but make no mistake about it, it’s the writer of the plan that benefits most by researching and writing the plan. Read more about shaping your business plan for different audiences at http://ow.ly/ahwlT

- How long will it take to write a business plan? The answer to this question will be different for each person. If you come to the business planning experience with knowledge about the business you’re starting, great computer and keyboarding skills, writing skills, knowledge of forecasting, and a window of time to do the work – your business plan shouldn’t take more than 50 to 100 hours, providing your personal life, your health, and your energy level allow room for the business planning project. For any of these things that are missing or complicated, add more time. As a couple of starkly different examples: the fastest business plan I’ve seen took a weekend to pull together (2 people working on it, and not including previous research done by both), and the longest took 2 years (after health issues, a blistering divorce battle and a few other issues along the way).

Those who proudly proclaim they do not have a plan send a very important message to lenders like me—they are either lazy or uncoachable—neither of which sets the climate for an enjoyable lender-borrower relationship. When a business gets into trouble, the lazy and uncoachable types are nowhere to be found, which means the lender is left to tidy up a costly mess.

If you’re starting or growing a small business, you’ll be further ahead if you do a business plan. It’s not easy to run a small business. The information you gather, the education you gain, the contacts you make—all add up to a huge win for anyone heading into a start-up or expansion.

If you’re starting or expanding a business, do the right thing for you and your family—take the time to research and write a business plan.