Determine your Start-up Expenses. These are all the costs related to getting your business up and running. It’s important to understand that you have some discretion as to which costs get included in start-up. Some analysts will include all the costs for months prior to the opening day and reflect this in the business plan by including a 15-month rather than a 12-month cash flow projection. I prefer to use a 12-month cash flow projection with the start-up costs slotted into the first month.

Another issue that can generate confusion is the difference between a start-up loan, an operating loan, a capital equipment loan, and an inventory loan. You do not need to get tangled up with the labels, as your banker or lending agency will slot the amounts into the appropriate categories.

Practically speaking, you need enough money at start-up to get you successfully to the operating stage.

Action

![]()

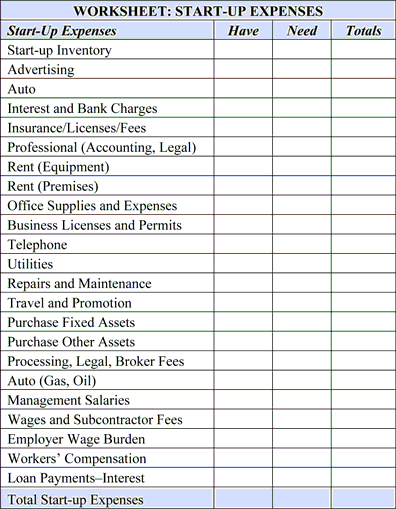

To complete this Element, you will need to determine what you must have in place to begin conducting business, and you must have researched the related costs, then:

- Enter all amounts you will need in place to begin doing business.

- In listing your Start-up Expenses, note that the Cash Flow Forecast includes all costs for the twelve months following the start-up. Be sure that you do not duplicate expenses by including them in both start-up and in your Operating Expenses.

View the Example: Start-Up Expenses

The Worksheet can be used to develop your Start-up Expenses Element. Work with your banker or business analyst to determine the best package for your situation.

* Click on this worksheet to download a copy to your computer