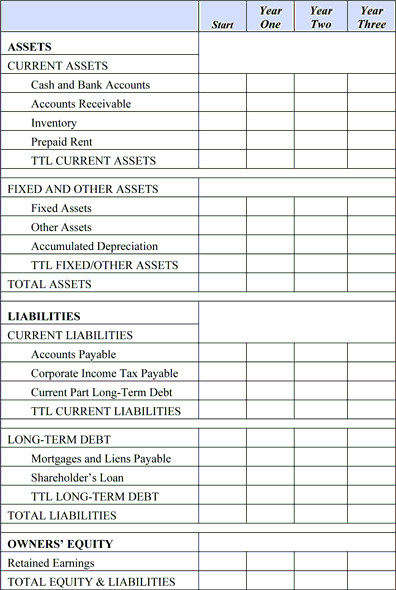

Determine the net worth of your business. It is a snapshot of your business at a specific time. If it is developed for some point in the future, it is referred to as a Pro Forma Balance Sheet.

When doing this Element, it is important to keep in mind that you are forecasting, not accounting; therefore, you are estimating.

Action

![]()

- To determine the net worth of your business, subtract liabilities from assets. The equation for this is: assets minus liabilities equal net worth.

- Estimate your total current assets. This will include all cash, inventory, prepaid expenses, and accounts receivable.

- Estimate your total fixed assets. This might include investments and capital equipment.

- Determine the current liabilities. This might include financial obligations, taxes owed, accounts payable, and unpaid bills.

- Calculate your long-term liabilities such as mortgages, bank loans and equipment leases.

Subtract your total liabilities from your total assets to determine your net worth. Net worth is the equity or money you have invested in your business. Check out a Pro Forma Balance Sheet Example and a Worksheet.

View the Example: Pro Forma Balance Sheet

* Click to download a copy of this worksheet to your computer